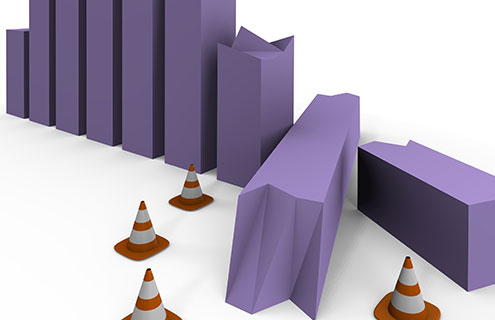

Hong Kong Exchanges and Clearing Limited (HKEX) has launched its Volatility Control Mechanism (VCM) for preventing extreme price volatility arising from extreme trading errors or other unusual events.

Intended to protect market integrity, the VCM launched on 22 August. Initially, it applies only to the Hang Seng Index and the Hang Seng China Enterprise Index constituents at the individual security level, currently 81 securities.

Under the mechanism, any attempt to trade a security at a price more than 10 percent different to its last traded price will trigger a ‘cooling off period’ of five minutes. In this time, the security will still be able to be traded, but within constraints.

These cooling off periods will be limited to one per security, per trading session. They will also not apply in the opening and closing auctions, or in the first and last 15 minutes of each morning and afternoon trading session, to allow for free price discovery.

Roger Lee, Head of Markets at HKEX, said: "The cooling-off period in the VCM mechanism alerts the market, provides a short time window allowing market participants to reassess their strategies and positions, and helps re-establish an orderly market at times when there is abrupt and drastic price movement for the security concerned."

He added: "The VCM is not intended to limit the ups and downs of stock prices due to fundamentals, and it should not be mistakenly seen as a trading halt mechanism or confused with the daily price limits that some markets use to keep a stock's trading within a specific price range."

HKEX first proposed the VCM in a consultation paper following G20 and International Organization of Securities Commissions (IOSCO) guidance on implementing control mechanisms to handle systemic risks arising from volatile market situations.

Through the consultation, HKEX concluded that there was substantial market support for a solution, and it also used suggestions in the responses to finalise features in the final VCM model.

Lee said: "Given that the VCM is designed to safeguard the market from extreme price volatility arising from major trading incidents, market participants should not expect it to take effect very often and should continue to exercise due care and remain cautious in their trading."

The mechanism will be rolled our in HKEX’s derivatives market in Q4—and will apply to spot-month and next-calendar-month contracts in the HIS, Mini-HIS, H-shares Index and Mini-HHI futures markets.

.jpg)