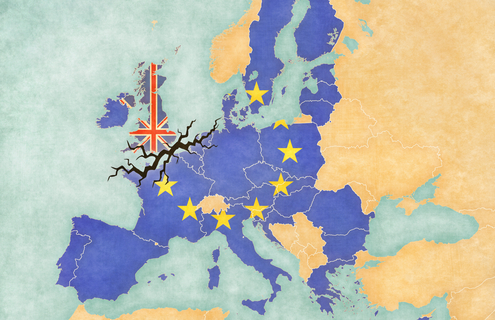

UK-based trade repositories may be forced to shoulder additional third-party recognition fees to operate under EU regulatory frameworks post-Brexit, according to proposed EU Commission rules.

The commission has opened the floor to industry participants to consult on proposed fees charged to trade repositories for incoming reporting rules, with all responses required by 14 December.

Fees levied under the auspices of the Securities Financing Transactions Regulation (SFTR) and the European Market Infrastructure Regulation (EMIR) will aim to cover necessary expenditure relating to the registration, recognition and supervision of trade repositories.

For all trade repositories, the application fee will reflect the expenditure necessary to accurately assess and examine the application for registration or extension of registration, taking into account the services to be provided by the trade repository, including any ancillary services.

A trade repository that does not provide ancillary services will be deemed to have a low expected total turnover and shall pay a registration fee of €65,000, while a repository that does offer ancillary services will need to pay €100,000.

In the event that trade repositories in the UK revert to third-party status after the March 2019 Brexit negotiation deadline, then firms will see a sharp increase to their annual fees in order to continue to operate in the continent.

A third-party trade repository applying for recognition under Article 19(4)(a) of SFTR shall pay a recognition fee of either €20,000, or the amount resulting from dividing €35,000 among the total number of trade repositories from the same third country that are either recognised by the EU, or that have applied for recognition, but have not been yet recognised.

There will also be an annual supervisory fee of €5,000.

Any late payments shall incur a daily penalty equal to 0.1 percent of the amount due.

All fees for third parties are non-refundable in the event that the application of recognition is rejected.

The European Securities and Markets Authority (ESMA), which has the delegates power to manage collected fees, has clarified that they shall only be set at a level that will cover costs, without accruing a surplus.

Where there is a recurrent significant surplus or deficit, the commission will revise the level of fees.

The commission has noted that, where a trade repository is already registered under EMIR, fees will be adjusted to reflect only the additional costs related to registration, recognition and supervision of trade repositories under SFTR.