EU leaders have a “strong argument” for bringing euro clearing into one of the remaining member states once the UK leaves the union, according to Roger Storm of SIX Securities Services.

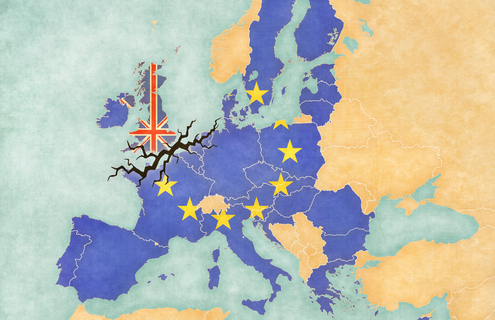

Financial services have proven to be an early point of contention ahead of Brexit negotiations. A German politician recently revived the prospect of legislating to require euro currency clearing, the majority of which takes place in the City of London, to be carried out in the eurozone.

Amid reports that the European Commission is planning to propose legislation in June that would centralise regulation, and possibly even require firms undertaking euro clearing to relocate, Roger Storm, head of clearing risk and development SIX Securities Services, said: “The precise impact of Brexit will boil down to whether the parties discussing the separation conclude a ‘benevolent transition’ or not. That said, if Brussels is intent on taking back euro clearing, issues such as competition, portability, licensing and access rights will all be secondary.”

“In some senses, there is a strong argument for them to do so. Central counterparty (CCP) clearinghouses secure liquidity and reduce risk, but they also bring a concentration of risk. Many will argue that it’s unreasonable to expect the European Central Bank to relinquish influence and control if a CCP in another market defaults—they need to have the control of the gas pedal and brakes of their car.”

Storm pointed to Euronext’s recent decision to place its clearing business with ICE Clear Netherlands, following the collapse of its deal to buy LCH.

Under the terms of their new partnership, clearing operations will be run from Amsterdam, while a new asset financing solution for inventory management and physical delivery for commodities will be built by Euronext and operated from Paris.

Euronext will contribute a €10 million upfront investment in ICE Clear Netherlands, and both parties have promised to cut headline clearing fees by 15 percent. The agreement will begin in Q2 and run for 10 years.

Storm said: “I would expect that all major banks have run a thorough assessment of Brexit, with a few scenarios up their sleeve. In the event of a hard Brexit, one of these options may involve breaking up and shifting a portion of their trading, clearing and collateral back to their respective currency zones.

“The outcome of conversations over the next few weeks is sure to make waves in the clearing and settlement sector, bringing an entirely new set of questions around collateral quality, access to clearing, and market consolidation.”

The prospect of losing euro clearing won’t fill the City of London with joy, as the loss of its ability to clear euro-denominated transactions would put hundreds of thousands of jobs at risk, according to a report from EY.