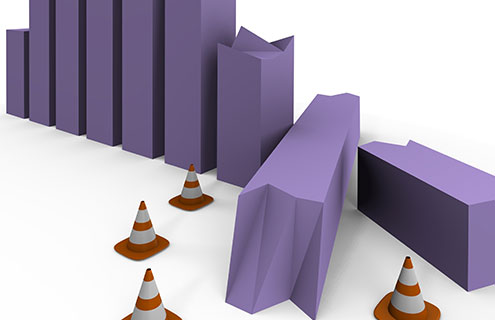

The European mutual funds industry saw net outflows of €1.4 billion from long-term mutual funds in December 2014, according to data from Lipper.

The only asset classes that experienced net inflows were mixed-asset funds, with €11.6 billion, and property funds with €300 million.

Bond funds had the greatest outflows of €5.7 billion, while equity funds saw outflows of €5.4 billion. On a lesser scale, commodity funds had outflows of €500 million and alternative and hedge products saw outflows of €300 million.

These figures brought 2014’s total net inflows down to €348 billion.

For money markets products, money markets finds reported outflows of €17.6 billion, but enhanced money markets funds had inflows of €30 billion. Net inflows for the year were reduced to €19.6 billion.

In terms of overall net flows, asset allocation was the best-selling sector for long-term funds, with inflows of €7.4 billion. This is followed by EUR corporate investment grade funds and EUR funds which each had inflows of €3.3 billion.

USD corporate HY funds had the largest outflows of €4.5 billion. This was bettered by global HY funds and equities Germany funds, which had outflows of €3.2 billion and €2.1 billion, respectively. Emerging markets in local currency funds also saw outflows of €2 billion.

Of the markets covered by Lipper, only 12 of 33 showed net inflows for long-term funds. The market with the highest net inflows was Italy with €2.5 billion, followed by Sweden with €2.2 billion and the UK with €2 billion.

Conversely, the international funds hubs saw the largest outflows of €8.3 billion. Norway had net outflows of €2.6 billion, and Portugal of €2 billion.

The Lipper report also made early projection for the January results, based on Luxembourg- and Ireland-domiciled long-term mutual funds.

Bond funds are likely to be the best-selling asset class with projected net inflows of about €11 billion. This is followed by mixed-asset funds with projected net inflows of €7.6 billion, and equity products with projected inflows of €5.5 billion.

According to the report, this suggests that European investors are back in a risk-on mode and buying back in to equity funds.