TradeTech 2025: Industry has mixed concerns about AI

14 May 2025 France

Image: Jack McRae

Image: Jack McRae

Attendees at TradeTech 2025 have a mixed range of concerns when it comes to using artificial intelligence (AI) in trading.

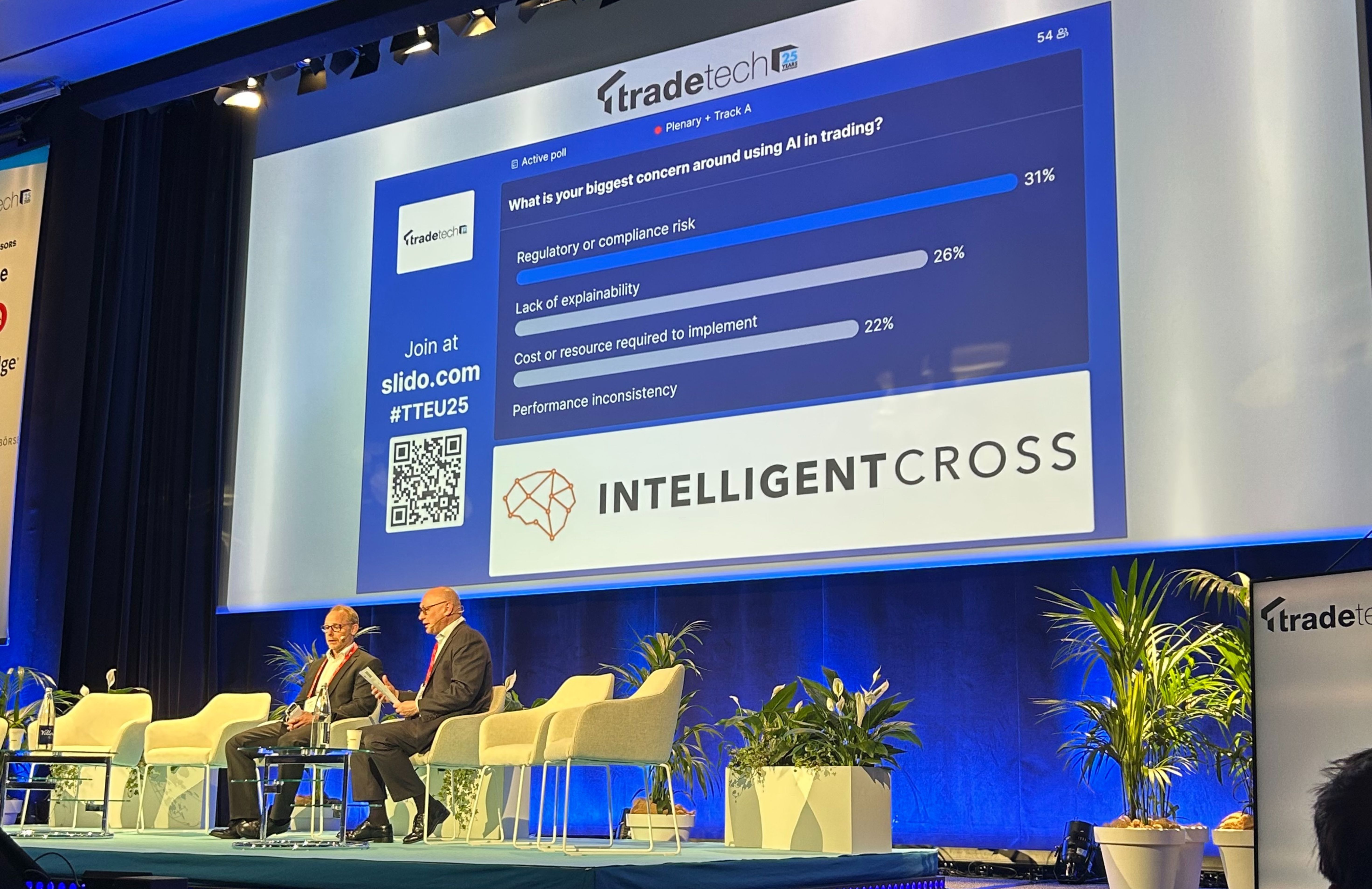

In a discussion between Mathias Eriksson, head of global equity execution at Andra AP-fonden (AP2), and Rob Boardman, CEO of Virtu Execution Services, EMEA, members of the audience were polled about their concerns.

Regulatory and compliance risk (31 per cent), lack of explainability (26 per cent), and cost or resource required (22 per cent) stood out as the leading concerns members of the industry hold.

“What are the concerns?” Boardman asked the crowd, before considering the results. “It is quite a mixed bag, with votes in all categories. These are things which you probably think about internally, Mathias. Do you have any questions internally about the use of AI in trading?”

Eriksson replied: “There are always people who are sceptical – It doesn't matter what organisation you are in. But my feeling, from an AP2 perspective, [our teams] are encouraging us to use new technologies.”

He continued to explain that these teams do conduct thorough evaluations of risks. He also added that replacing the human with AI in the process will not make the process perfect — but nor should it.

“It's not a question of ‘is the AI perfect?’, but of ‘is it better or more optimal that what we did before?’,” Eriksson said.

The impact of AI in trading was also considered in the proceeding panel focusing on automation and analytics. Stuart Lawrence, head of equity trading at UBS Asset Management, stressed that AI is the future — and is developing rapidly.

“I think anyone who sees AI as something to replace them is not looking at the full picture,” Lawrence explained. “It is a very useful tool that we can use to make our lives easier, and I expect it to come quickly.

“I go back to the previous presentation and most of us aren't using it from a trading perspective. [But] where we can use it, is for mining that historical data.”

Lawrence believes that using AI to consider historical data which can then be put back into the algo wheel is “the next step.”

He adds: “I think having that historical data and the depth of insight that that can bring can really inform real-time routine.”

In a discussion between Mathias Eriksson, head of global equity execution at Andra AP-fonden (AP2), and Rob Boardman, CEO of Virtu Execution Services, EMEA, members of the audience were polled about their concerns.

Regulatory and compliance risk (31 per cent), lack of explainability (26 per cent), and cost or resource required (22 per cent) stood out as the leading concerns members of the industry hold.

“What are the concerns?” Boardman asked the crowd, before considering the results. “It is quite a mixed bag, with votes in all categories. These are things which you probably think about internally, Mathias. Do you have any questions internally about the use of AI in trading?”

Eriksson replied: “There are always people who are sceptical – It doesn't matter what organisation you are in. But my feeling, from an AP2 perspective, [our teams] are encouraging us to use new technologies.”

He continued to explain that these teams do conduct thorough evaluations of risks. He also added that replacing the human with AI in the process will not make the process perfect — but nor should it.

“It's not a question of ‘is the AI perfect?’, but of ‘is it better or more optimal that what we did before?’,” Eriksson said.

The impact of AI in trading was also considered in the proceeding panel focusing on automation and analytics. Stuart Lawrence, head of equity trading at UBS Asset Management, stressed that AI is the future — and is developing rapidly.

“I think anyone who sees AI as something to replace them is not looking at the full picture,” Lawrence explained. “It is a very useful tool that we can use to make our lives easier, and I expect it to come quickly.

“I go back to the previous presentation and most of us aren't using it from a trading perspective. [But] where we can use it, is for mining that historical data.”

Lawrence believes that using AI to consider historical data which can then be put back into the algo wheel is “the next step.”

He adds: “I think having that historical data and the depth of insight that that can bring can really inform real-time routine.”

NO FEE, NO RISK

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times

100% ON RETURNS If you invest in only one asset servicing news source this year, make sure it is your free subscription to Asset Servicing Times