The most important result to come out of this year’s R&M Fund Accounting & Administration Survey is the fact that all providers are seen to have coped remarkably well with the challenging conditions in 2020 with COVID-19, lockdowns and working from home

A very different year from any other we have experienced, with the large numbers of employees working from home, new challenges and agendas reprioritised. Unlike a lot of events this year, the R&M Fund Accounting & Administration Survey still went ahead as planned.

The survey, which was conducted between June and September, received responses from 87 fund managers.

The survey questionnaire asked a total of 38 questions broken down into six categories covering core fund accounting and administration, fund valuation, communication, approach and flexibility, quality of personnel and value for money.

Although there were some interesting results from this year’s survey, the most important results to come out of the survey is the fact that all providers are seen to have coped remarkably well with the challenging conditions in 2020 with COVID-19, lockdowns and working from home.

One respondent said: “RBC are positioning themselves as a role model in how to effectively transition their business to a work-from-home arrangement with no impact on their deliverables.”

This comment could have applied to any of the providers, all having dealt well with new working arrangements.

Another survey participant, discussing State Street’s service, revealed they acted “exceptionally well managed and we were kept informed with regular updates”.

“There was some delay in pricing during the initial phase of the pandemic due to volatility and delays from third parties. But we were kept informed each day with estimated delivery times,” they added.

On Northern Trust, one respondent explained: “From a service perspective we have not seen any decline in service or had any issues related to the day to day operations of our fund and the provider has done a good job of communicating updates to their remote work situation and plans to return to the office as they continue to develop.”

“The biggest compliment I can pay is we wouldn’t even know the staff weren’t in the office. There has been no deterioration in the service levels whatsoever,” said another manager about HSBC.

All in all, fund managers have given a ringing endorsement to the well-laid contingency plans of providers that have now been tried and tested for real.

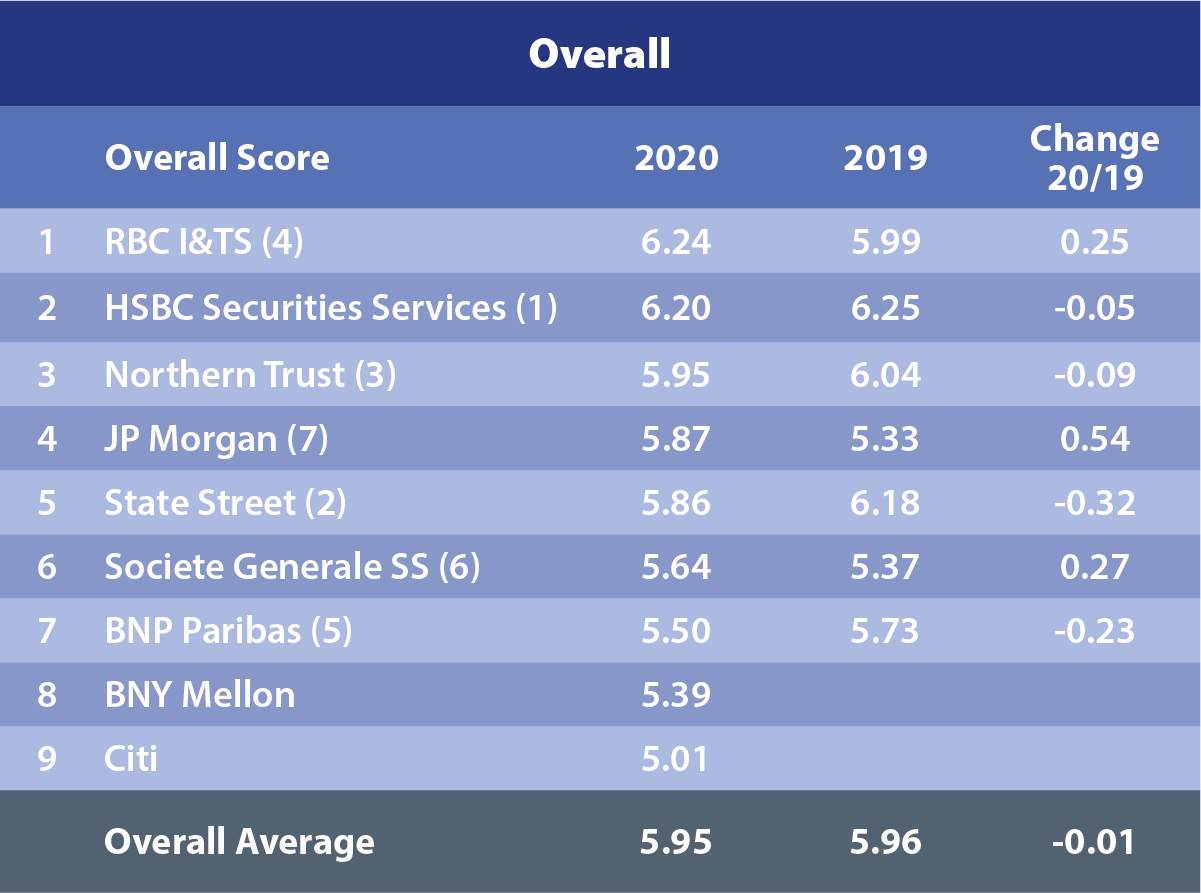

Overall results

The 2020 overall results showed RBC Investor and Treasury Services (RBC I&TS) regaining the top spot, pushing HSBC into second place. Meanwhile, State Street slipped into fifth and Northern Trust held onto third place. J.P. Morgan witnessed the most significant gain, jumping 0.54 points into fourth.

The majority of respondents were very satisfied with service levels at most providers.

One manager commented: “RBC set themselves up as a class-leading administrator, speaking from personal experience from working with numerous administrators in the market. Communication is important from a client perspective and there is little to fault with RBC. Any questions are met with a timely considered response or at least the promise to provide one.”

Elsewhere, another stated: “Northern Trust has been exceptionally efficient and very supportive to all our requests with great willingness to be flexible whenever we had issues that needed sorting out. They were very fast to respond and very professional in all the advice and support they gave.”

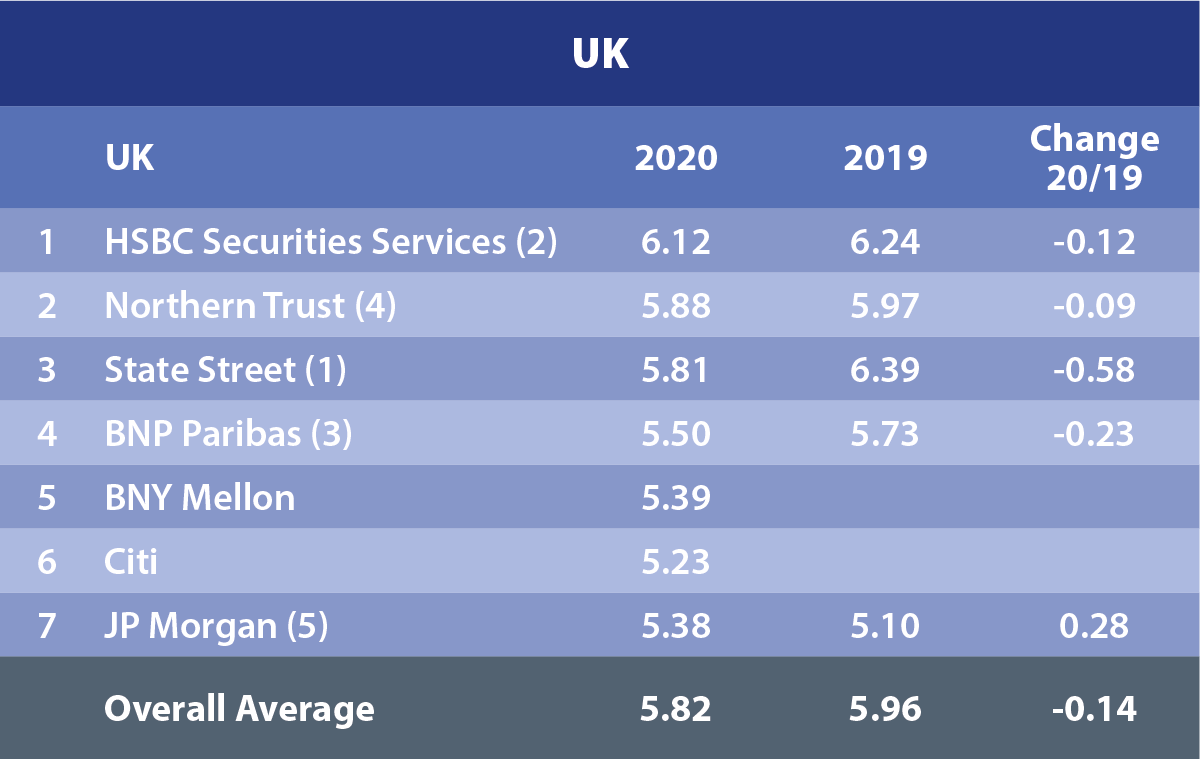

UK

In the UK State Street lost its first place, being pushed aside by HSBC followed by Northern Trust in second. Out of all the service providers, J.P. Morgan had the only gain of 0.28, even though it dropped from fifth to seventh.

Commenting on HSBC’s service, one respondent said: “We have a large number of complex accounts. All require the staff at HSBC to be responsive to queries when issues arise. Our experience over a number of years is that the team, especially on the client relationship side is exceptionally knowledgeable and responsive to our requests.”

Elsewhere, a Northern Trust client stated that the speed of response to queries was very client centric and attentive while transaction types did not encounter anything that Northern Trust couldn’t handle.”

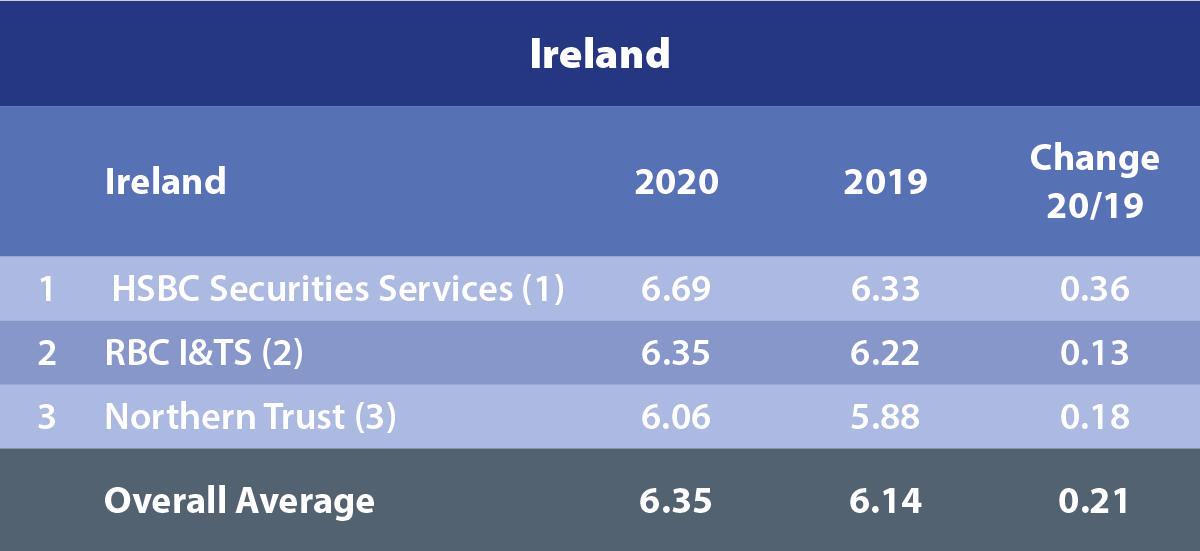

Ireland

In Ireland, HSBC came top once again gaining 0.36 on last year’s score. RBC remained in second place with 6.35, an increase of 0.13 from 2019’s result. The third bank to qualify was Northern Trust totalling 6.06.

“The team at HSBC provide an exceptionally timely and accurate service. Regular key performance indicator meetings keep us well informed with detailed and knowledgeable explanations being provided,” according to one survey participant.

Meanwhile, an RBC client said: “Every person we deal with (at RBC) communicates in a clear and consistent manner, always providing timely feedback and information for any requests or inquiries made.”

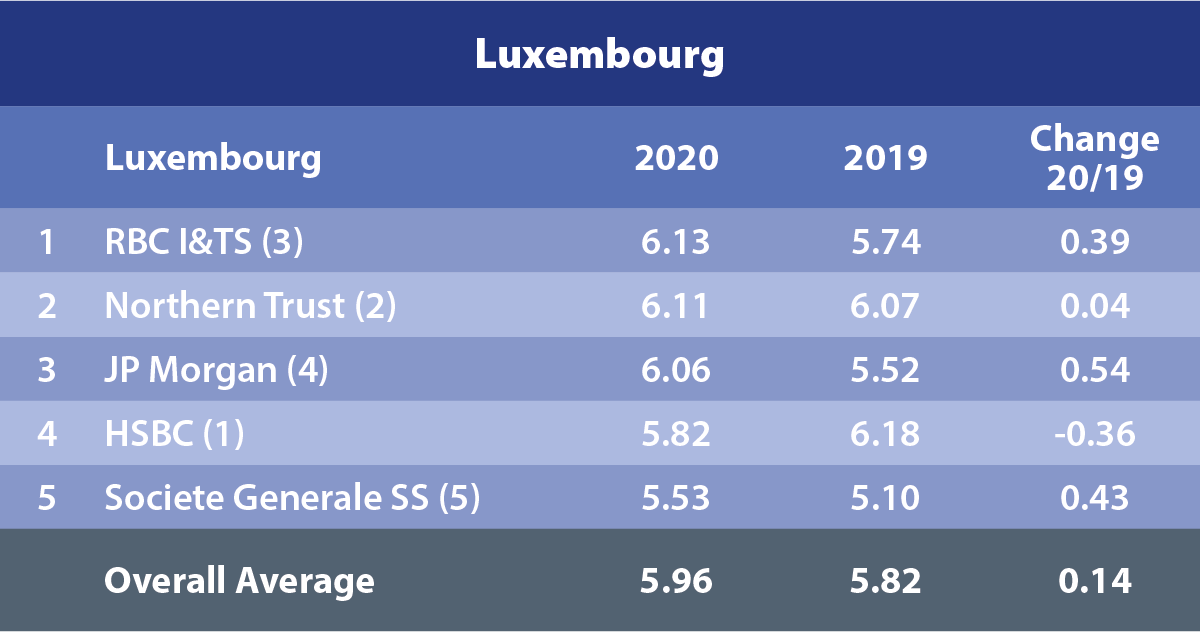

Luxembourg

Finally, in Luxembourg, RBC edged ahead of Northern Trust to take first place. HSBC fell back to fourth, dropping 0.36 from its score last year. The biggest increase was from J.P. Morgan who scored 6.06, compared to 5.53 in 2019.

Societe Generale remained in fifth place but did increase its score by 0.43, taking this year’s total to 5.53.

One survey participant revealed: “The accounting and administration team are always up to speed on current issues, quickly resolving any potential problems in a proactive manner so as not to impact the daily net asset value pricing. RBC are flexible in their approach to providing a top-class service.”

Another highlighted that Northern Trust has been “exceptionally efficient and very supportive indeed to all our requests with great willingness to be flexible whenever we had issues that needed sorting out. They were very fast to respond and very professional in all the advice and support they gave”.